Reducing and preventing your credit data rejections

Our robust reject analytics tool delivers actionable visibility into key trends, drivers, and individual occurrences causing submissions to be rejected, equipping our clients to swiftly pinpoint root causes and enable corrective measures for more accurate consumer reporting.

Core features

Selected key features of the Signal tool

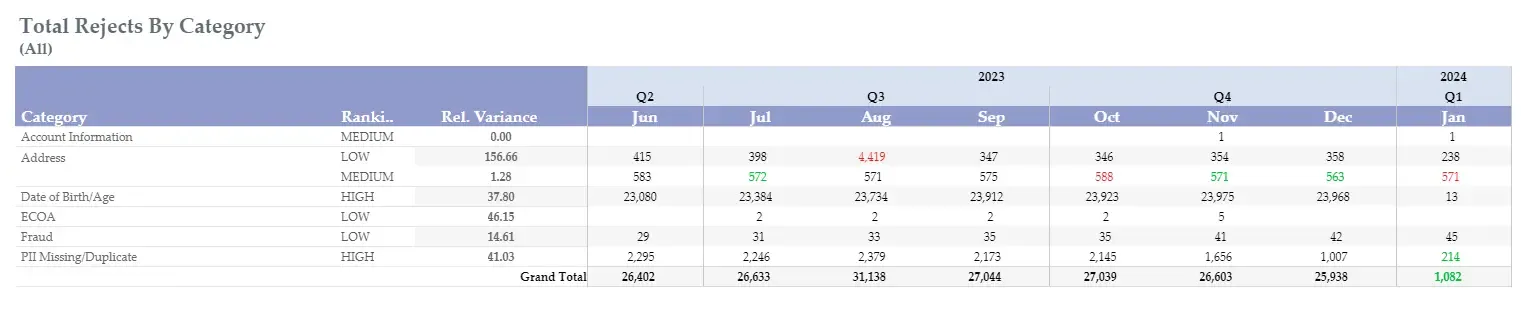

Comprehensive Reject Data Tracking

Ingests rich historical reject data across furnishing channels, building an extensive reference library of reject types, frequency, and identified root causes for analysis.

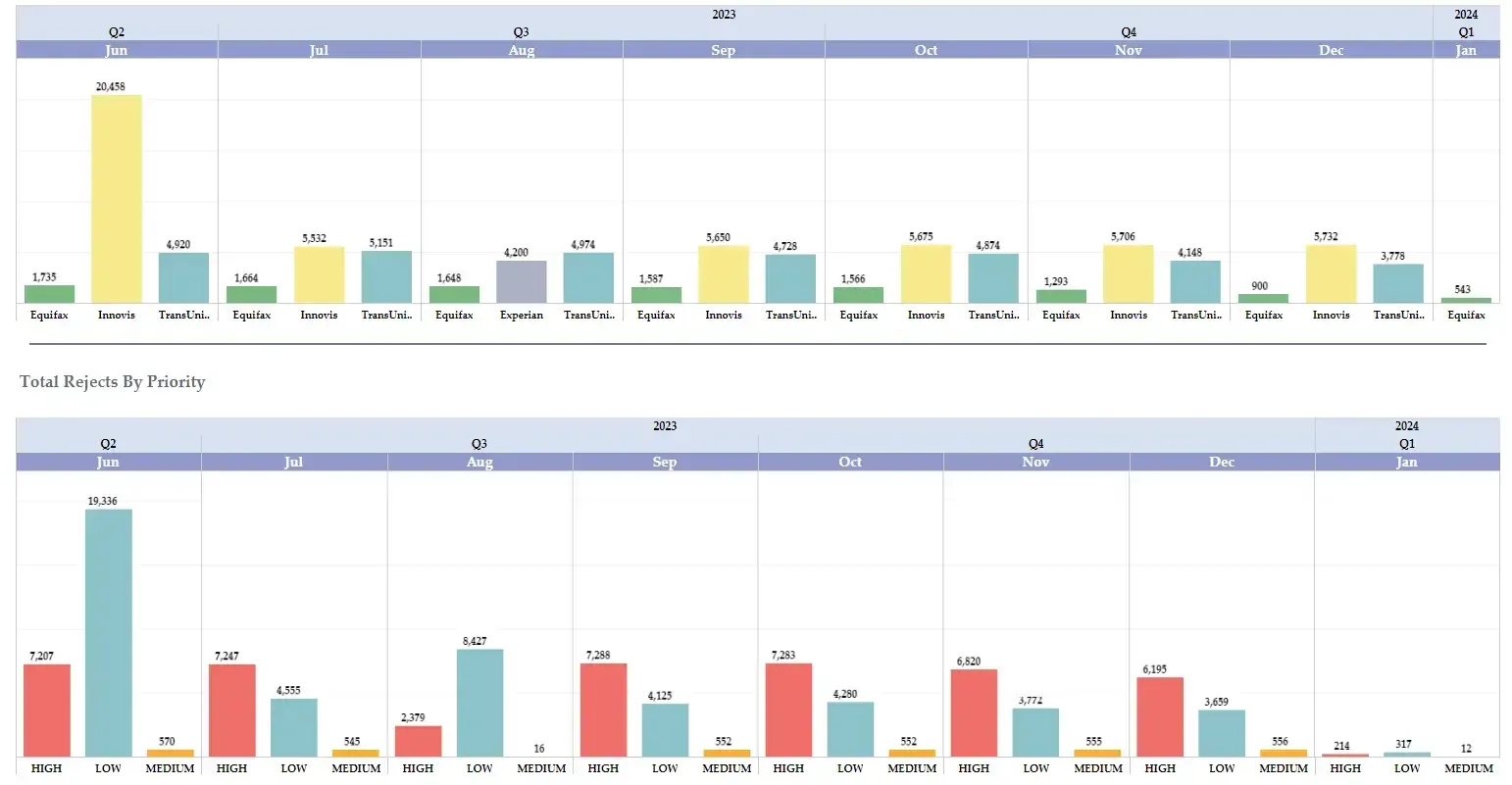

Reject Rate Analytics and Reporting

Enables deep analysis of overall rejection rates and trends providing metrics segmentation by reason, product, cohort, and other dimensions through visual dashboards.

Our analytics reveal the concealed drivers of rejects to enable clients to fix credit reporting that combines data and cross-team collaboration.

Swift Root Cause Identification

Leverages statistical pattern recognition across reject data to rapidly diagnose root causes behind rejection occurrences, clusters, trends and anomalies to expedite contextual understanding.

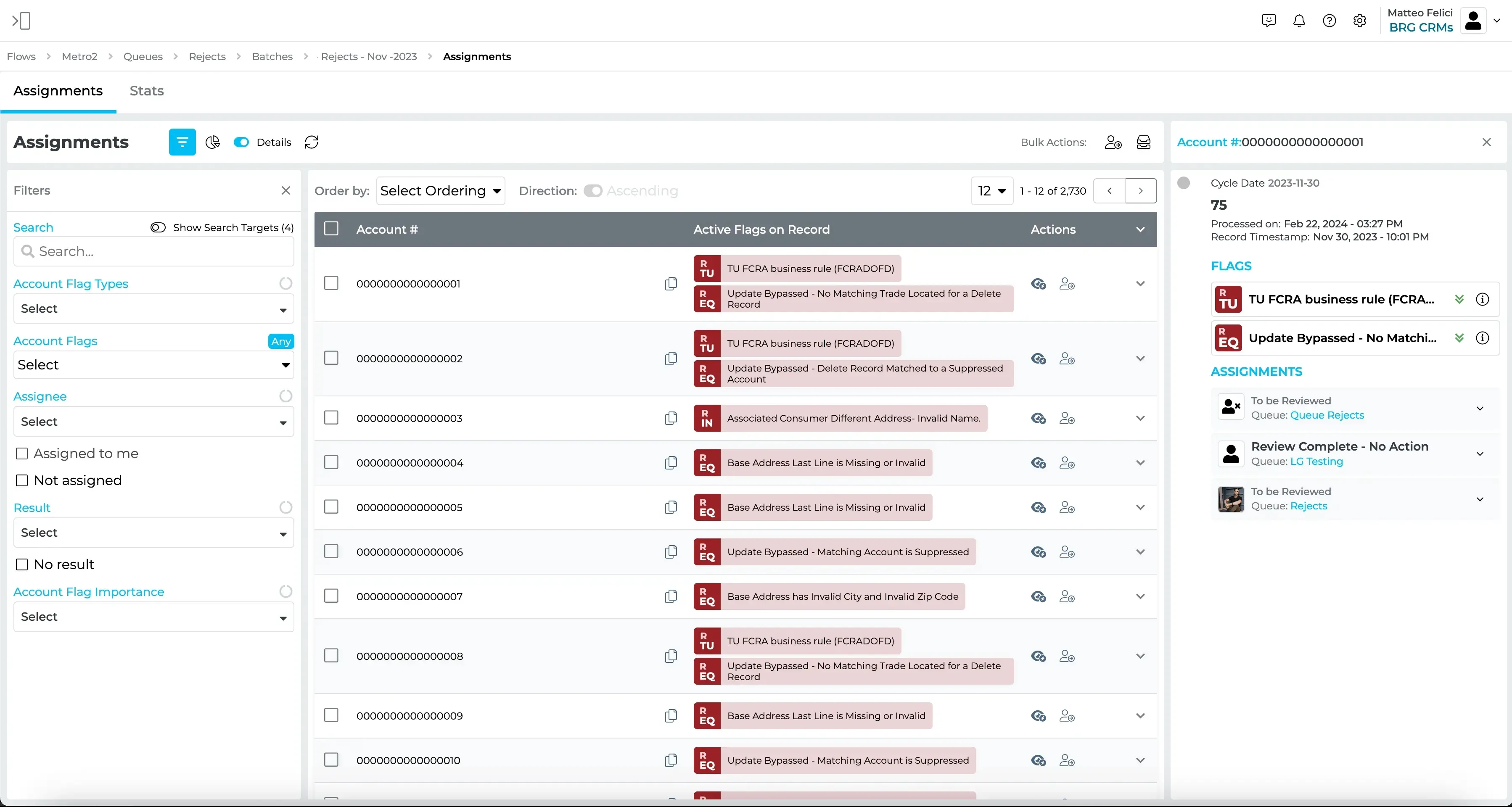

Streamlined Corrective Workflows

Our platform connects insights to operational remediation with a practical workflow and remediation process through our Stream workflow management tools. Finish the process faster with a compliant audit trail.